Retirement provision

Save tax with pillar 3a.

Most people know that you can save tax with pillar 3a. But few realise that this pillar has yet more benefits in store.

With a pillar 3a, you can save tax not only when paying in, but also when your balance is paid out. Our expert Marco Palermo explains how to save enough to pay for your next holiday or even a family car.

1. Save tax when paying into pillar 3a

You can deduct everything you pay into pillar 3a from your taxable income. Depending on which canton you live in, how much you earn and pay in, you may be able to save as much as CHF 2,000 in tax annually with your pillar 3 account.

Example: Mustermann family

Take a look at how much you could save as a family, using the example of the Mustermanns. Petra (34) and André (35) live with their two children, Emilia (6) and Tobi (4), in a rented apartment in Neuchâtel.

Monthly household income:

- André earns CHF 4,715 a month, net, working on an 80% basis.

- Petra earns CHF 1,768 net, working on a 30% basis.

- Between them, they have a monthly income of CHF 6,483 plus CHF 400 in child allowances.

| Annual payments into pillar 3a | Amount |

|---|---|

| André Mustermann | CHF 1’000 |

| Petra Mustermann | CHF 1’000 |

Like most families. André and Petra Mustermann are unable to save the maximum amount each year. Between them, they pay CHF 2,000 into pillar 3a each year. The Mustermann family live in the canton of Neuchâtel. Their pillar 3a payments allow them to save quite a lot on tax:

- Tax savings per year (average over entire savings period): approx. CHF 600

- Tax savings in just under 30 years (tax-adjusted): approx. CHF 14,000

Every year in which you are not paying into a pillar 3a account is a lost year. It is not possible to pay into pillar 3a on a retroactive basis. Our experts will find the right pension plan for you that will allow you make considerable tax savings.

What is the situation in other cantons?

The following table shows how much tax you can save per year if you live in the respective canton’s capital and are paying CHF 4,000 (2020) there into pillar 3. When paying in the maximum amount, the above savings will increase by around a third – except if you live in Altdorf.

Tax savings per year when paying CHF 4,000 into pillar 3a

Calculation basis: Married, two incomes (70% and 30% workload), two children, no church tax.

| Canton/Municipality | CHF 50,000* | CHF 70,000* | CHF 90,000* | CHF 120,000* |

|---|---|---|---|---|

| AG/Aarau | 167 | 394 | 501 | 824 |

| AI/Appenzell | 191 | 397 | 534 | 676 |

| AR/Herisau | 305 | 592 | 717 | 887 |

| BE/Bern | 297 | 672 | 733 | 896 |

| BL/Liestal | 0 | 891 | 910 | 1,206 |

| BS/Basel | 0 | 0 | 594 | 998 |

| FR/Fribourg | 72 | 535 | 629 | 972 |

| GE/Genève | 0 | 0 | 643 | 1,108 |

| GL/Glarus | 375 | 517 | 611 | 853 |

| GR/Chur | 0 | 165 | 593 | 866 |

| JU/Delémont | 165 | 637 | 790 | 951 |

| LU/Luzern | 0 | 568 | 609 | 772 |

| NE/Neuchâtel | 54 | 775 | 943 | 1,141 |

| NW/Stans | 19 | 413 | 579 | 739 |

| OW/Sarnen | 0 | 513 | 683 | 763 |

| SG/St. Gallen | 0 | 614 | 615 | 965 |

| SH/Schaffhausen | 186 | 426 | 553 | 739 |

| SO/Solothurn | 365 | 588 | 713 | 959 |

| SZ/Schwyz | 36 | 330 | 452 | 601 |

| TG/Frauenfeld | 0 | 476 | 627 | 889 |

| TI/Bellinzona | 0 | 0 | 302 | 919 |

| UR/Altdorf | 0 | 1,488 | 547 | 547 |

| VD/Lausanne | 74 | 465 | 651 | 933 |

| VS/Sion | 24 | 185 | 463 | 731 |

| ZG/Zug | 0 | 0 | 105 | 215 |

| ZH/Zurich | 0 | 282 | 429 | 743 |

Source: Own calculation based on the tax calculator provided by the Federal Tax Administration.

2. Save tax when withdrawing your money from pillar 3a

There are also some tax tips to keep in mind when withdrawing your pillar 3a funds. It’s best to start planning withdrawals from your pension early.

Advantage 1: Taxed at the reduced rate

When your pillar 3a funds are paid out, you have to pay tax on them. The tax rate differs from canton to canton, but every canton taxes pillar 3a funds separately from usual income such as wages, pensions, income from investments, etc.. This also applies to the federal tax. The withdrawal will be taxed at one-fifth of the income tax rate.

Advantage 2: Save by staggering withdrawals

You can have your 3a balance paid out at the earliest five years before the regular AHV retirement age. Women at 59, men at 60. If you work beyond retirement age, you can still pay into pillar 3a for a maximum of five years after reaching regular retirement age. That means up to age 69 for women and up to age 70 for men.

When withdrawing pillar 3a funds, you always have to withdraw the total amount that's in your account. Hence you should consider having multiple pillar 3a accounts right from the start. This will allow you to draw on your funds on a staggered basis over the years. This way, you do not end up paying higher rates of tax under the progressive tax system (disproportionate tax charge on each additional taxable franc from pension plan 3a).

Plan right

When you plan your retirement, take into account other funds to be paid out:

- Your spouse’s pension (PK/3a)

- Lump-sum withdrawals from your pension fund (PK)

- Money from a vested benefits account

An example from the canton of Aargau

- There is CHF 480,000 in the pension fund and CHF 120,000 in pillar 3a.

- If you pay tax on the pension fund, it will cost you around CHF 36,000.

- If you defer withdrawing your pillar 3a assets to the following year, you will pay tax of around CHF 4,700.

- If you were to have both paid out in the same year, you would pay around CHF 6,000 more in tax.

What is the situation in other cantons?

| City (canton) | Pension fund CHF 480,000 | Pillar 3a CHF 120,000 | Tax staggered in CHF | Tax not staggered in CHF |

|---|---|---|---|---|

| Aarau (AG) | 36,000 | 4,700 | 40,700 | 46,700 |

| Altdorf (UR) | 27,800 | 5,100 | 32,900 | 35,400 |

| Appenzell (AI) | 26,400 | 3,900 | 30,300 | 33,700 |

| Basel (BS) | 44,900 | 7,000 | 51,900 | 57,700 |

| Bellinzona (TI) | 28,500 | 5,300 | 33,800 | 36,300 |

| Bern (BE) | 36,700 | 5,200 | 41,900 | 49,100 |

| Chur (GR) | 23,500 | 4,100 | 27,600 | 30,000 |

| Delémont (JU) | 37,900 | 6,500 | 44,400 | 48,400 |

| Frauenfeld (TG) | 35,000 | 6,900 | 41,900 | 44,500 |

| Fribourg (FR) | 53,600 | 6,800 | 60,400 | 69,800 |

| Genève (GE) | 34,200 | 4,500 | 38,700 | 44,700 |

| Glarus (GL) | 32,400 | 6,300 | 38'700 | 41,200 |

| Herisau (AR) | 37,500 | 7,200 | 44,700 | 49,400 |

| Lausanne (VD) | 54,300 | 7,800 | 62,100 | 71,900 |

| Liestal (BL) | 30,900 | 4,600 | 35,500 | 45,900 |

| Luzern (LU) | 38,700 | 5,700 | 44,400 | 49,900 |

| Neuchâtel (NE) | 42,400 | 7,700 | 50,200 | 53,800, |

| Sarnen (OW) | 34,700 | 6,800 | 41,500 | 44,000 |

| Schaffhausen (SH) | 29,900 | 3,800 | 33,800 | 38,000 |

| Schwyz (SZ) | 34,100 | 2,400 | 36,500 | 48,600 |

| Sion (VS) | 43,000 | 5,600 | 48,700 | 60,900 |

| Solothurn (SO) | 36,700 | 5,300 | 42,100 | 47,400 |

| St. Gallen (SG) | 34,600 | 6,800 | 41,500 | 43,900 |

| Stans (NW) | 36,700 | 5,900 | 42,700 | 46,600 |

| Zug (ZG) | 29,300 | 2,900 | 32,200 | 37,900 |

| Zurich (ZH) | 38,200 | 5,800 | 44,100 | 57,100 |

Calculation basis: Tax rate for married people without church tax. Rounded to CHF 100.

Generali tip

From around CHF 60,000 to 80,000, it is worthwhile investing in a new pillar 3a account since tax progression starts at this amount. You should also avoid drawing on pillars 2 and 3 in the same year. In this way, you can make further tax savings, as shown by the table and example above.

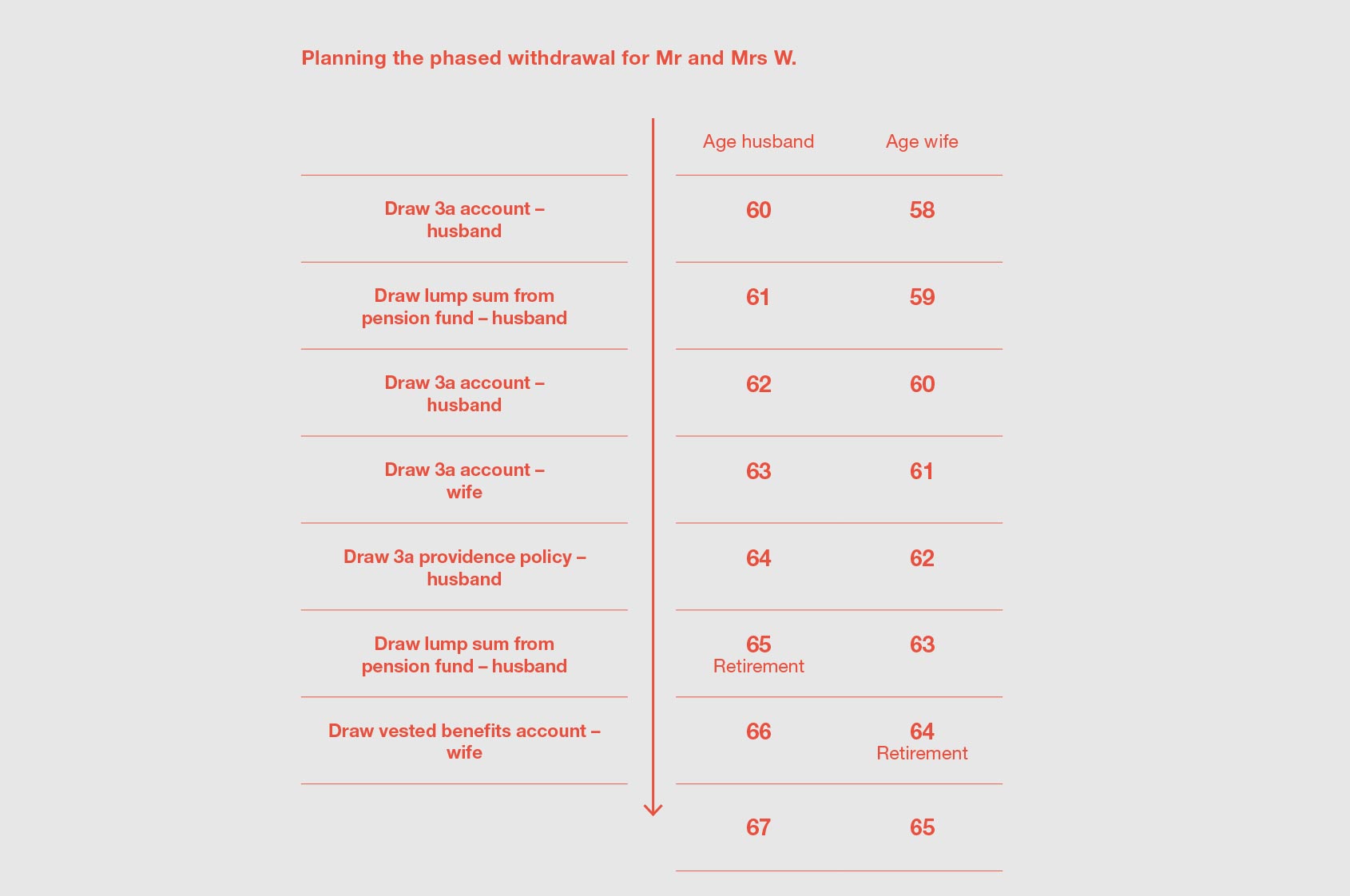

Withdrawal plan example

One possibility for a withdrawal plan could look like this. Mr and Mrs W.’s phased withdrawal could involve drawing on their pension assets over a period of seven years before retirement.

- 1st year: Draw first 3a account, husband

- 2nd year: Draw lump-sum from pension fund, husband

- 3rd year: Draw second 3a account, husband

- 4th year: Draw 3a account, wife

- 5th year: Draw 3a providence policy, husband

- 6th year: Draw lump sum from pension fund, husband on retirement

- 7th year: Draw vested benefits account, wife on retirement

Our conclusion

A pillar 3a account makes it easy to save tax. To do so, you just have to bear a few tips and tricks in mind. Over a period of 30 years, this highly effective pension and savings account will allow you to save enough to pay for a family holiday or even a car.

Suitable insurance products

Contact

Contact

Find an agency

Find an agency

Close

Close