Retirement provisions

How good are my retirement provisions?

Comfortable retirement: how to use the pillar system for maximum effect.

At last you have more time. When working life ends, there are beautiful things in life that still await you. But will your pension give you the financial freedom to fulfil your retirement dreams? Here are our tips for a worry-free old age with the three-pillar system.

It’s never too early to think about old age and how you want to spend the last third of your life. Life expectancy is rising. Today, people generally live for about another 20 years after they retire. This time has to be financed. The sooner you make provisions for your old age, the easier it will be for you to enjoy your retirement. We’ll show you how it’s done.

Switzerland's three-pillar system

If you use the three-pillar system correctly, you won’t have to worry about your finances in old age. This is how it works:

Pillar 1: AHV. If you live or work in Switzerland, you’ll receive an AHV or state pension upon retirement. Usually the AHV pension is not enough to live on. In this case, you can apply for supplementary benefits. The AHV is a state-operated pension facility.

Pillar 2: occupational pension. This is the money in your pension fund. If your annual salary exceeds a certain threshold, you are automatically insured as an employee in your company’s pension fund. The pension paid by the pension fund, together with your AHV pension, will equal about 60% of your last salary. Your employer is responsible for your occupational pension scheme.

Pillar 3: private pension provision. This pension provision is voluntary. This means, it’s up to you to decide whether or not to pay into pillar 3. Here you have two options:

- Qualified provident insurance 3 a: Ideally, you pay money into a bank account or life insurance policy on a regular basis to use after you retire.

- Voluntary provident insurance 3b: this form of provision includes, for example, your own flat or house, securities and life insurance policies. You can terminate or liquidate your voluntary provident insurance at any time.

When you retire, you will receive a monthly pension from pillar 1 and 2. However, these funds only partially replace the income you earned prior to retirement. And the amounts of the pensions paid under pillars 1 and 2 are tending to decrease. This is why qualified provident insurance 3a is becoming increasingly important. Many people invest in pillar 3 private pension facilities over a period of decades to ensure they will be able to finance their accustomed lifestyle once they retire. This is possible with the income from all three pillars.

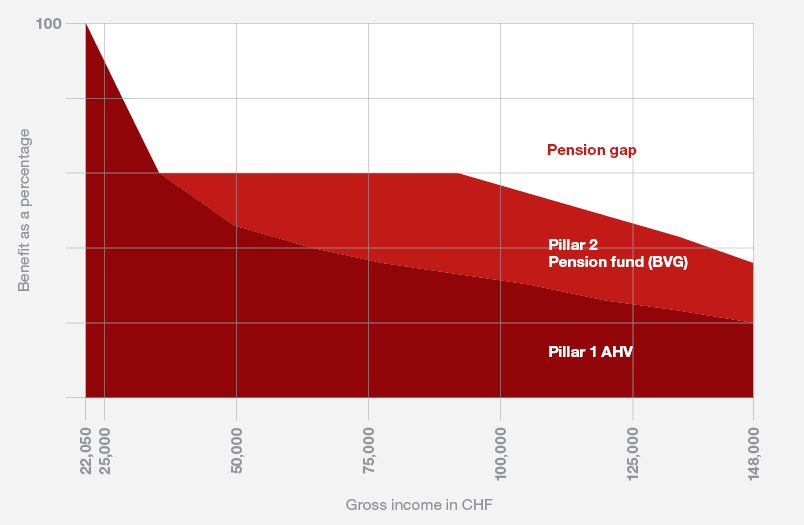

What is a “pension gap”?

The cost of living in old age can vary a lot. If you assume that your budget will be the same after retirement as it is before retirement, then you are playing it safe. Normally, 70-80% of your last salary is enough for you to continue living as you did before retirement. Your pensions from the AHV and from your pension fund should together therefore amount to 70–80% of your last salary. If the amount is lower, the difference is referred to as a "pension gap".

How large a pension gap actually is depends to a great extent on what you want and on your preferred lifestyle. Some people need very little money in old age and hardly feel the gap. Others will have expensive hobbies after retirement and will want to travel. The more money you need in your everyday life, the larger the gap in your pension provision will become.

How to work out whether you have a pension gap

You can work out for yourself whether you might be facing a pension gap after retirement. You’ll need to know your approximate income and expenses.

Income

after retirement, your income will consist primarily of your AHV pension and the pension from your pension fund:

- The AHV pension is a minimum of CHF 1,260 and a maximum of CHF 2,520 per month (as at 2025). Married couples receive a joint maximum pension of’ CHF 3,780 per month. This reduction for married couples is called a "ceiling".

- Your pension certificate shows how much your pension from the pension fund will be. However, this amount is only an assumption and is not guaranteed. Your pension will only reach that level if you and your employer continue making full contributions to the pension fund without any gaps. Also, the interest rate and conversion rate must not decline. The conversion rate is used to calculate the pension you will receive based on the assets you have accumulated in the pension fund.

Expenditure

it is best to assume that you will spend the same amount of money after retirement as you did before. Then you can’t go wrong. An accurate estimate is difficult for several reasons:

- You will pay more tax because you will no longer be able to deduct professional expenses and payments into your qualified provident insurance 3a. On the other hand, in old age your assets will become smaller, which in turn will reduce your taxes.

- In your everyday life you will probably spend about the same amount of money. Or maybe a little more, because you’ll have more time for hobbies. Or because your doctor’s bills may be higher. Those who are less adventurous in old age than they were in the past are more likely to live more economically.

Do you have any questions about the three-pillar system? Our advisors will help you analyse your personal pension situation.

Suitable insurance products

Contact

Contact

Find an agency

Find an agency

Close

Close