Media release , 19.09.2022

Financial uncertainty forcing Swiss people to cut back on spending

Inflation, energy crisis and potential wars – current developments are unsettling the Swiss population. As a result of inflation, many people are tightening their belt. One area particularly affected here is money the Swiss put aside for retirement provision. But respondents are also cutting back on their household and leisure spending, according to a Swiss-fluencer.ch survey commissioned by Generali Switzerland.

| Titel | File | Size | |

|---|---|---|---|

| Media release, 19.09.2022 | 0,4 Mb |

|

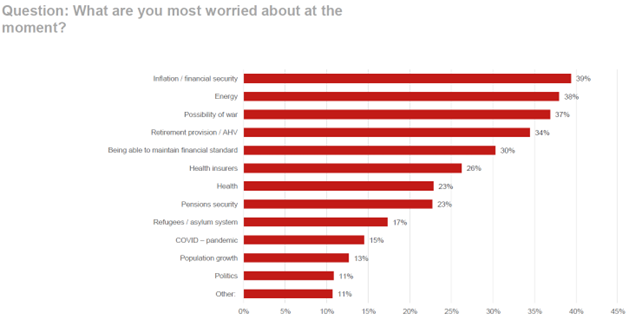

Personal financial security and inflation are currently the main causes of concern for the Swiss (39 per cent). Thirty per cent of respondents also fear not being able to uphold their financial position. In addition to these financial woes, the Swiss population is especially concerned about the energy problem (38 per cent) and potential wars (37 per cent). But retirement provision is also a cause for concern for about a third of those surveyed. This is the finding of a representative survey conducted by Swiss-fluencer.ch on behalf of Generali Switzerland.

Swiss people are unable to save as much for their old age

Two thirds of the Swiss feel directly affected by the current state of financial insecurity (67 percent). This concern can be seen particularly in people just beginning their careers and in those about to retire. Of the respondents who feel affected, the majority (81 per cent) say that they are paying less into their private pension plans as a result. Likewise, many people (78 per cent) are no longer able to save as much as they used to. And two out of three respondents say they are having to cut back on leisure activities and household purchases. Despite experiencing the effects of rising inflation first hand, only ten per cent of respondents have reached out for professional advice.

Despite its declared importance, only 56 per cent save for a pension

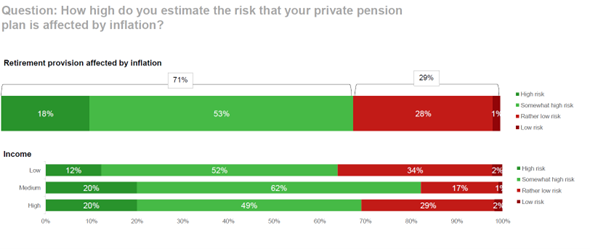

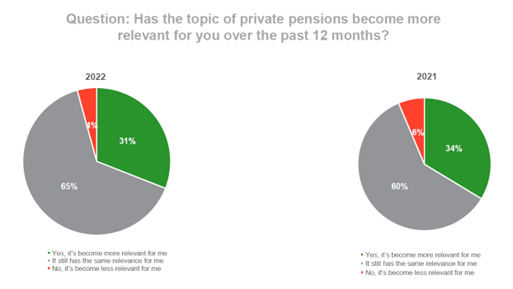

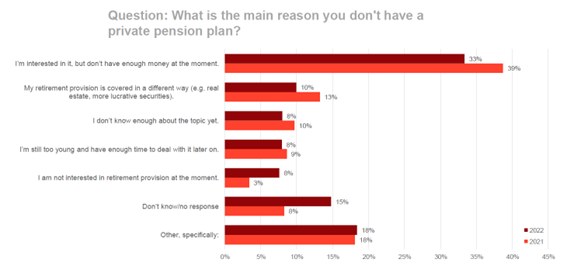

The subject of retirement provision is rated as very important by most Swiss (81 per cent) Comparing the survey with the previous year shows that private retirement provision remains just as important for most people (65 per cent) or has even increased in importance (31 per cent). And yet, only just over half of the respondents (56 per cent) save for old age through a private pension. Household income plays a particularly large role in this. Among people in a high-income household (over CHF 8,000 gross per month), 78 per cent save for life after retirement. Conversely, only 38 per cent of respondents in households earning less than CHF 6,000 gross per month pay into a private pension. This finding is also reflected in the response to the question of why they do not save any money. Here, 33 per cent of respondents state that they don’t have a private pension because they simply don’t have the money. With regard to occupational pensions, voluntary contributions to a pension fund are only taken up by a small number of Swiss people: although 79 per cent are aware that they can buy into a pension fund, only 28 per cent of those surveyed have already done so.

Swiss people are not very risk-averse when it comes to saving

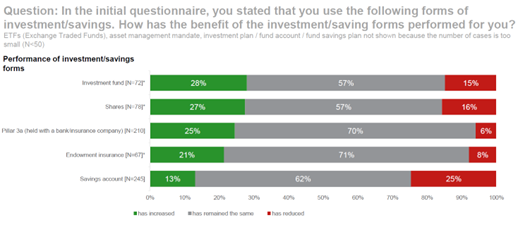

In uncertain times, most respondents still turn to their savings account. But a growing number of them see this form of saving is becoming less attractive. Accordingly, 25 per cent of respondents state that their savings account is not as relevant for them as it was in the previous year. In second place behind the savings account is pillar 3a. A quarter of respondents state that this form of saving has become more relevant for them. Only six per cent state that they see less benefit in pillar 3a. Rene Priess, Director Products & Services Life at Generali Switzerland, had this to say here: “Third pillar savings are particularly attractive for many Swiss people due to the tax advantages. Even those who can’t afford the maximum annual amount should definitely use this savings option. Even small, regular payments can help to provide for retirement in the long term through the compound interest effect.”

Investment funds and equities gain in popularity

Although savings accounts and the third pillar are the most used forms of savings, respondents see the biggest potential in investment funds and shares. For 28 per cent, the benefits of investment funds has increased compared to the previous year. In the case of equities, 27 per cent of the respondents report an increase in relevance. At the same time, around one sixth state that the benefit of both forms of investment had decreased from their point of view. “Anyone relying on funds or shares for their pension provision must remain cool-headed when crises come along and think long-term,” says Rene Priess. “With a savings horizon of ten, twenty or thirty years and regular payments into a fund, for example, the average cost effect evens out the effects of crises or increased volatility.”

The survey, representative of the population as a whole, was carried out by Swiss-fluencer.ch on behalf of Generali Switzerland between 9 and 14 August 2022, with 390 people taking part.

Contact us

We will be happy to respond to your media inquiries.

Contact

Contact

Find an agency

Find an agency

Close

Close